doordash mailing address for taxes

Dashers pay 153 self-employment tax on profit. Please contact the moderators of this subreddit if you have any questions or concerns.

How To File Taxes As An Independent Contractor Everlance

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

. Restaurants and more delivered to your door. Doordash mailing address for taxes Monday June 6 2022 Edit. If you have any 1099-specific questions we recommend reaching out to Doordash or Stripe directly.

United States and Canada. EIN for organizations is sometimes also referred to as taxpayer identification number TIN or FEIN or simply IRS. Up to 12 cash back Breakfast lunch dinner and more delivered safely to your door.

DoorDash drivers are expected to file taxes each year like all independent contractors. This is a flat rate for gig work so youll pay the same. You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time.

The self-employment tax is your Medicare and Social Security tax which totals 1530. The email address associated with your DoorDash account is incorrect missing or unable to receive mail. If you did not select your delivery option.

The Doordash mileage deduction 2022 rate is 625 cents per mile starting from July 1. It may take 2-3 weeks for your tax documents to arrive by mail. Internal Revenue Service IRS and if required state tax departments.

With the standard deduction option. Dashers are self-employed so they will pay the 153 self-employment tax on their profit. The rate from January 1 to June 30 2022 is 585 cents per mile.

DoorDash currently sends their. If you have not received an. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

The employer identification number EIN for Doordash Inc. Tax Forms to Use When Filing DoorDash Taxes. It doesnt apply only to.

Call Us 855-431-0459 Live chat. How Do Taxes Work with DoorDash. A 1099-NEC form summarizes Dashers earnings as independent.

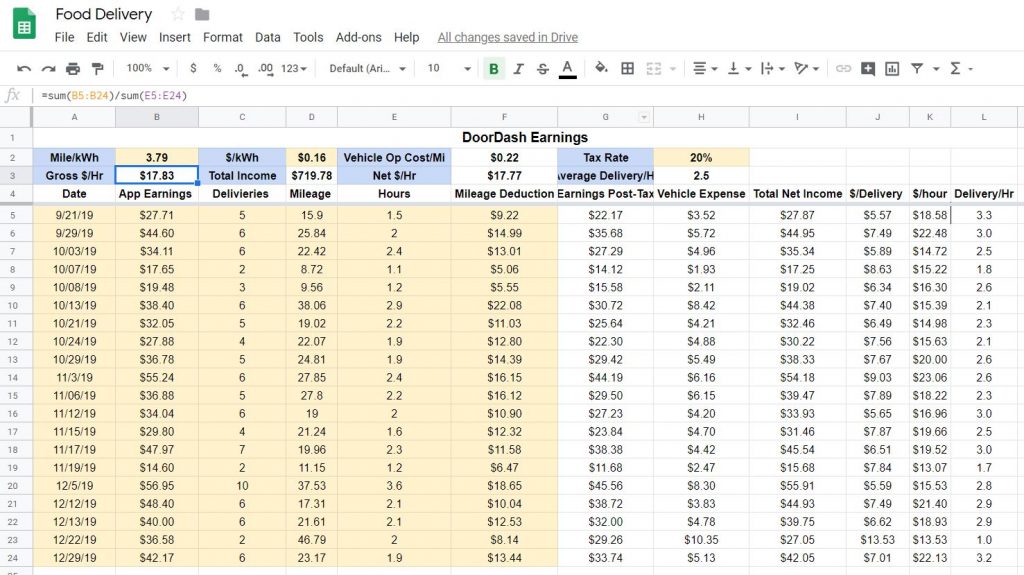

Lets assume you work for Doordash for 40 Hours a week. Dashers will not have their income withheld by the. Now offering pickup no-contact delivery.

DoorDash will send you tax form 1099. Paper Copy through Mail. Doordash can be reach via phone at 855-973-1040 or through their support.

The email address associated with your DoorDash account is incorrect missing or unable to receive mail. In order to evaluate if Doordash is worth it after Taxes we need to evaluate the tax calculations and numbers in details. It should be included in the 1099 info that Doordash sends you.

Yes - Just like everyone else youll need to pay taxes. If you earned more than 600 while working for DoorDash you are required to pay taxes. DoorDash has chosen to postal deliver forms to you.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. DoorDash also said in 2019 that the average DoorDash driver can earn around 1850 per hour. The forms are filed with the US.

If youd like to speak to a merchant sales representative you can contact us online or call us Monday-Friday.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash With An Electric Vehicle Charged Future

How To Become A Doordash Driver In 2020 Gigworker Com

Doordash 1099 How To Get Your Tax Form And When It S Sent

Is Doordash Worth It Earnings Tax Deductions And More The Compounding Dollar

How Do I Begin Doordash Driving Everything You Need To Know Toughnickel

How To File And Take Care Of Your 1099 Doordash Taxes

Doordash S 3 Laws Of Deception I List Out 3 Ways In Which Doordash By Rahul G Medium

Doordash 1099 Forms How Dasher Income Works 2022

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Introduces Ultra Fast Grocery Delivery Providing Busy Consumers With A Reliable And Convenient Way To Restock Instantly

Toast Delivery Services Troubleshooting Faq S

Doordash Taxes Does Doordash Take Out Taxes How They Work

Tips For Filing Doordash Taxes Silver Tax Group

How To Do Taxes For Doordash 2020 Doordash Dasher Podcast Podcasts On Audible Audible Com

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

Charge Me For Tax When There Is None I Am From Montana Where There Is Currently No Sales Tax When I Place My Order However There Is Always A Tax On My